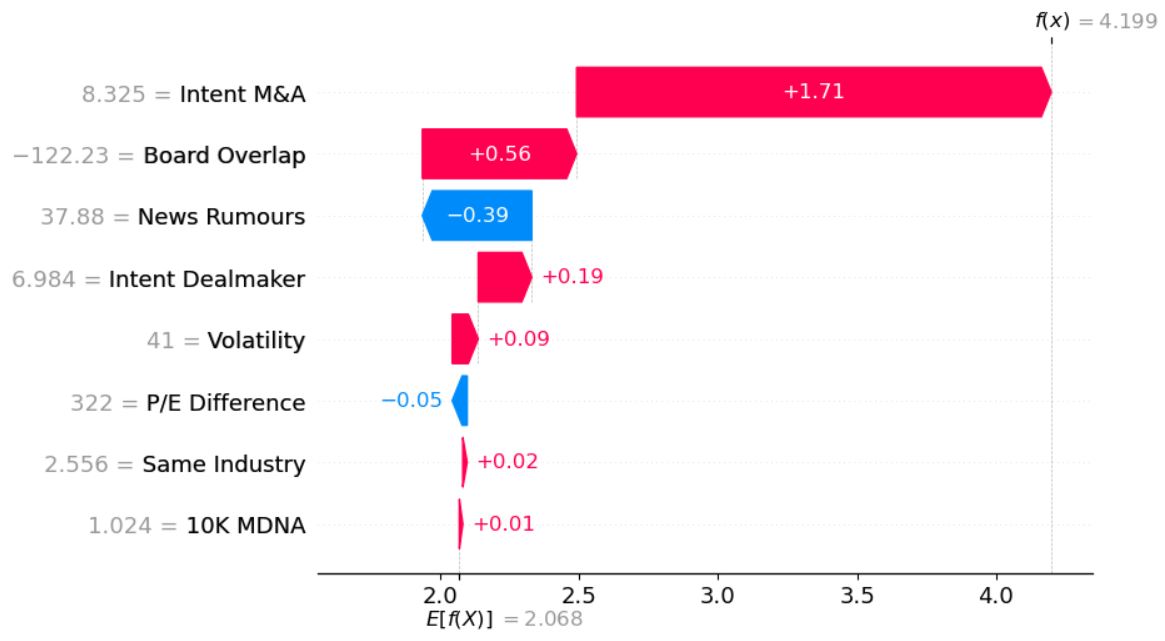

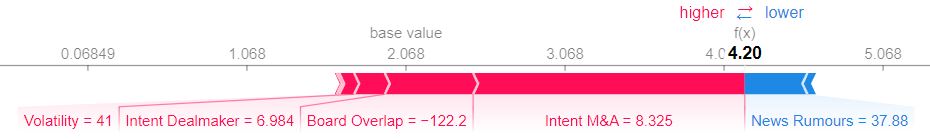

What's driving the prediction?

The forecast's primary influencing factors stem from the increase of web research activity on mergers and acquisitions (M&A) originating from the company. Additionally, the presence of overlapping board members in key companies contributes to the overall prediction. However, a mitigating factor is the reduction in market speculation driven by news rumors.

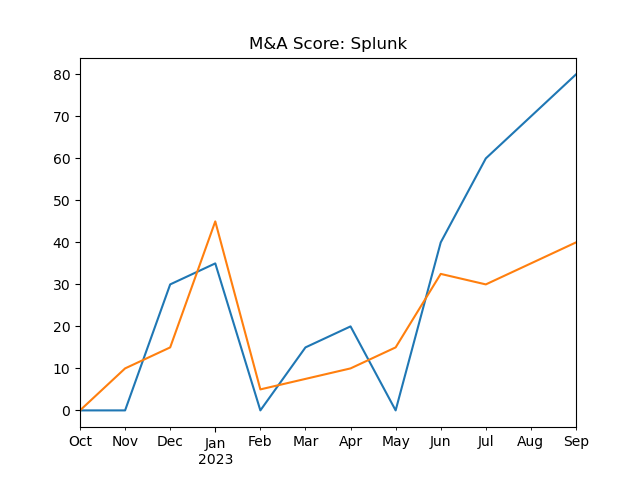

What's changed?

Over the last week, the top change drivers are: web research activity (+300%), stock volatility (+10%), offset by reduced news rumors (-30%).

About the score

M&A Score acts as a leading indicator of a company looking for an exit in the next 3 – 12 months. It was created by analyzing research activities of thousands of targets of lower to mid-market acquisitions.

Given a list of companies (either provided by you, generated by Fintent or both), we’ll return an M&A score for each company with some additional context indicating the likelihood of the company looking to sell their business in the near future. Learn more